Last Updated on Mar 1, 2024 by Ayushi Gangwar

Investing is often touted as one of the most effective ways to build wealth over time. Investing in Equity Linked Savings Scheme (ELSS) funds has long been synonymous with tax-saving strategies. However, beyond its tax-saving benefits, ELSS serves a bigger purpose – it helps build discipline and fosters a culture of long-term investing. Keeping this in mind Zerodha Fund House launched ELSS Largecap Midcap Funds as an effective tool for cultivating disciplined investment habits while offering exposure to the potential of Indian equities. Let’s delve into how investing in this fund can help inculcate a disciplined investing habit:

Table of Contents

1. Long-Term Wealth Creation

Investing in this fund is primarily geared towards long-term wealth creation. By staying invested over the long term, investors can benefit from the power of compounding as their investments grow over time. This fund helps you build an investing discipline with a lock-in period of 3 years. This disciplined approach of investing regularly, coupled with the tax-saving benefits, accelerates wealth accumulation and helps investors achieve their financial goals effectively.

2. Low Investment Threshold

Zerodha Tax Saver fund offers the flexibility to start investing with a relatively low initial investment amount of ₹500. This low entry barrier makes it accessible to a wide range of investors, including beginners who may be hesitant to commit a large sum initially. By starting small and gradually increasing investments over time, investors can develop a disciplined investing habit without straining their finances.

3. Simplified Investment Approach

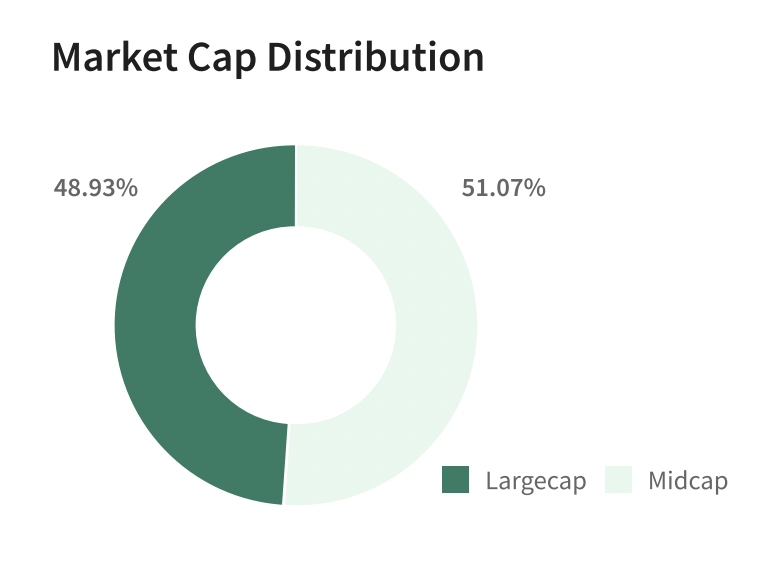

This fund follows a simple investment strategy by equally allocating funds between the top 100 large companies and the next 150 midcap companies. This approach takes the guesswork out of investing for beginners, as it provides diversified exposure to established largecap companies and promising mid-cap firms without constant monitoring and decision-making.

4. Tax Saving Benefits

One of the key attractions of ELSS funds is their tax-saving benefit under Section 80C of the Income-tax Act, 1961. Investments made in ELSS funds up to ₹1,50,000 are eligible for a tax deduction, making them an attractive option for individuals looking to save on taxes while building wealth for the future. This added incentive encourages investors to allocate a portion of their income towards long-term wealth creation.

5. Balanced Risk-Reward Profile

Midcap companies, although potentially offering higher returns, tend to be more volatile compared to largecap companies. By diversifying investments equally between largecap and midcap companies, the Zerodha Tax Saver fund aims to strike a balance between risk and return. This balanced approach is particularly beneficial for investors with a long-term horizon, as it helps mitigate the volatility associated with midcap stocks while capturing their growth potential.

Who could benefit from investing in this fund?

Zerodha ELSS Largecap Midcap Fund offers an excellent opportunity for investors to build a disciplined investing habit while enjoying the benefits of tax savings and diversified exposure to the equity market. With a simplified investment approach, balanced risk-reward profile, and low investment threshold, these funds provide an ideal starting point for individuals looking to embark on their investing journey. By harnessing the potential of these funds and staying committed to their investment goals, investors can pave the way for long-term financial success and security.

Disclaimer: Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.

- FAQs: Loans Against Mutual Funds on Tickertape - Jan 19, 2026

- Loans Against Mutual Funds: A New Offering from Tickertape! - Jan 19, 2026

- Christmas’25 on Tickertape. Terms and Conditions - Dec 15, 2025