Last Updated on Oct 27, 2023 by Ayushi Gangwar

Investors are always on the lookout for simple and transparent investments in the equity market. Enter Zerodha Fund House, India’s sole AMC dedicated to crafting passive investment products. Zerodha Fund House offers a sweet spot for investors who have a longer-term horizon in mind when it comes to investing. The recent introduction of two new NFOs by Zerodha Fund House marks the advent of a long-anticipated era of passive investing—a development eagerly awaited by investors. The two said funds follow the Nifty LargeMidcap 250 index which partakes the 50-50 division of Large caps and Mid-cap companies in India, carefully creating a balanced, and diversified portfolio.

Table of Contents

What is the Nifty LargeMidcap 250 Index?

At the heart of the funds is the Nifty LargeMidcap 250 Index, a beacon of stability in a dynamic market. The fund tracks the NIFTY LargeMidcap 250 index and it invests in the top 250 companies in India. It not only diversifies investments across companies but also spreads across different sectors; like Financial Services, Oil and Gas, Healthcare etc.

Aligns With India’s Growth Story

The index puts money in Large-cap and mid-cap stocks in a 1:1 ratio. This diversification allows the index to be spread across 20+ sectors, aligning with the growing economy of India. The goal of such diversification is to ensure that Largecaps bring stability to the portfolio and Midcaps bring extra growth potential. The index rebalances itself every quarter, so for example; Midcaps perform better than Largecaps, it rebalances the allocation, and vice versa.

Offers the sweet spot across Large and Mid-cap companies

The 1:1 split of the fund between Large and Mid-cap companies offers a sweet spot of proven performance over the years. The fund is a balanced fit between the Nifty 100 and the Nifty Midcap 150 index, which helped the index never witness negative returns in the 7-year and 10-year investment horizon, based on daily rolling return analysis.

Zerodha Nifty LargeMidcap 250 Index Fund

Imagine investing without the headache of meticulous stock picking. This fund takes your money and allocates it equally between the top 100 large companies and the next 150 midcap companies, offering a harmonious blend of stability and growth. With a minimum investment of ₹100, it paves the way for a simplified and optimized approach to passive investing.

Check out this fund here!

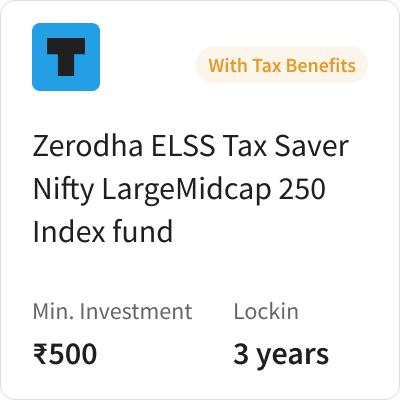

Zerodha ELSS Tax Saver Nifty LargeMidcap 250 Index Fund

This fund not only mirrors the Nifty LargeMidcap 250 Index but adds a unique tax-saving benefit to the mix. Investments, up to ₹1,50,000, become a tool for both wealth creation and tax optimization under section 80C of the Income-tax Act, 1961. It’s not just an investment; it’s a strategic move in the chessboard of financial planning. You can get started with a minimum investment amount of ₹500, with a Lockin period of 3 years.

Check out this fund here!

Keep in mind;

| Different offerings | Zerodha Nifty LargeMidcap 250 Index Fund | Zerodha ELSS Tax Saver Nifty LargeMidcap 250 Index Fund |

| Minimum Investment Amount | ₹100 | ₹500 |

| Lock-In Period | No Lock-in | 3 years |

| Investment Strategy | Regular investment fund | Tax-saving Fund |

| NFO Last Date | 3rd November 2023 | 3rd November 2023 |

Who are these funds for?

These funds become a tailored fit for investors seeking simplicity and stability in their financial journey. If you are an investor with a longer-term horizon, desiring a hassle-free and uncomplicated approach to wealth creation, Zerodha’s NFO funds beckon.

Whether you are a seasoned investor looking to diversify your portfolio or a novice taking your first steps into the world of investing, these funds provide a balanced and transparent avenue.

If you’re an investor who’s looking for tax-saving funds to invest in, Zerodha ELSS Tax Saver Nifty LargeMidcap 250 Index Fund is the right choice for you.

So, if simplicity, transparency, and a commitment to passive wealth creation resonate with your investment philosophy, consider this your invitation to embark on a journey where your financial goals align seamlessly with the ethos of Zerodha’s NFO funds. After all, in the world of investing, the most successful journeys are the ones that reflect the values and aspirations of the investors themselves.

Check out the funds by Zerodha Fund House here.

- FAQs: Loans Against Mutual Funds on Tickertape - Jan 19, 2026

- Loans Against Mutual Funds: A New Offering from Tickertape! - Jan 19, 2026

- Christmas’25 on Tickertape. Terms and Conditions - Dec 15, 2025