Investors can use various metrics and ratios to analyse the performance and standing of a company. One of the popular metrics is the ROCE ratio.

ROCE (Return on Capital Employed) is an important indicator of a company’s performance and profitability. It helps evaluate a company’s profits from the total capital used. Let’s read about ROCE meaning, its formula and more.

You will Learn About:

What is ROCE?

Return on capital employed is a financial ratio used to assess the company’s efficiency in generating profits as a percentage of the total capital used by the company. This ratio is extensively studied by all stakeholders, including investors, managers, potential investors, etc., to understand the returns that are being generated on capital employed.

ROCE tells the investors and managers how efficiently the company uses its capital. Companies aim to maximise their ROCE as higher profits and returns can be reinvested for future growth and expansion of the business.

Return on equity: Highlights

- Return on capital employed is a financial ratio that helps determine a company’s profitability and efficiency in generating profits.

- Return on capital can be calculated by dividing the Earnings Before Interest and Taxes (EBIT) by the total capital employed.

- Return on capital employed is an important financial metric used by the stakeholders to take significant financial and investment decisions for the company.

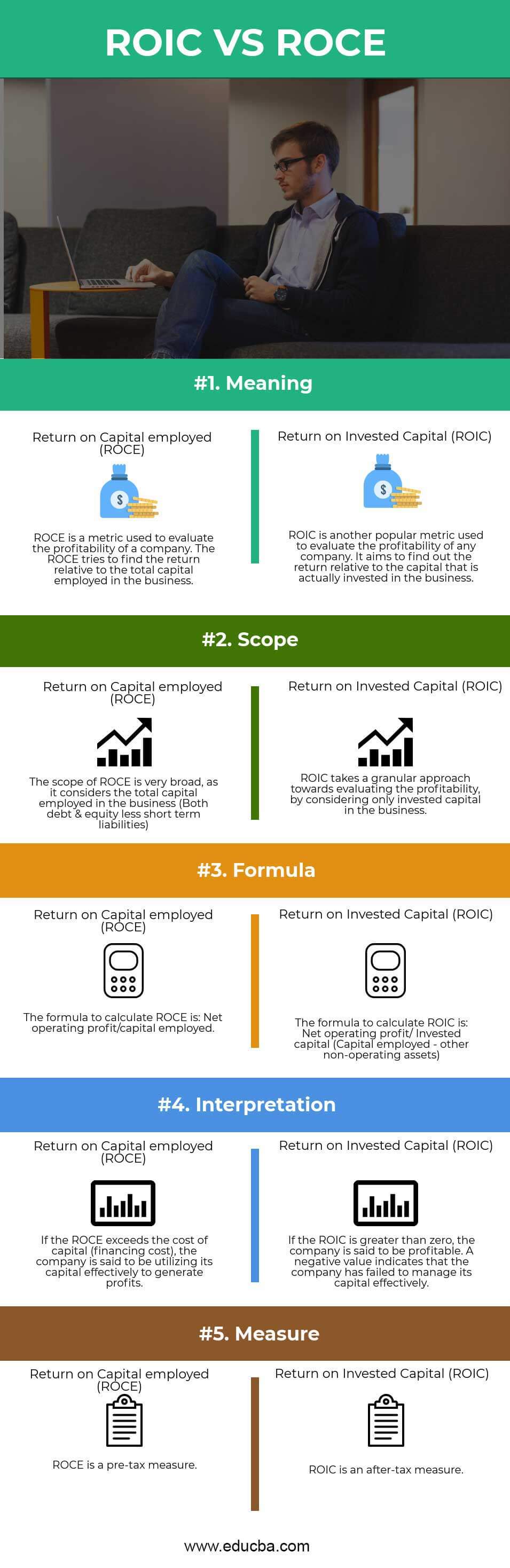

- Return on capital employed differs from return on invested capital because capital employed is comparatively broader in scope.

ROCE formula

Return on capital employed can be calculated using the following formulas-

Return on capital employed = Earnings before interest and tax / Capital employed

Return on capital employed = Earnings before interest and tax / ( Total assets – Total current liabilities )

Return on capital employed = Earnings before interest and tax / ( Shareholder’s equity + long-term debt )

Here, EBIT (Earnings Before Interest and Tax) is the operating income from the regular activities of the business. EBIT is calculated by deducting operating expenses and the cost of goods sold from the total revenue. It does not include financial earnings, interest payments, taxes, etc.

Additionally, capital employed refers to the amount invested in a business. It is calculated by adding the shareholder’s equity and the long-term debt. It can also be calculated by deducting total non-debt related liabilities from total assets.

How useful is the ROCE as an indicator of a company’s performance?

Return on capital employed is an important financial metric for measuring a company’s performance. This is because it determines the earnings generated over the total employed capital, thereby determining how efficiently the company uses the business’s total capital to generate earnings before interest and tax.

Therefore, the return on capital employed is a good indicator of the company’s performance and is also considered by investors before taking any investment decisions.

Is the return on investment the same as the return on capital employed?

ROI and ROCE are common financial ratios used by investors. They are also used interchangeably by many, but it is important to note that both are different concepts.

Let’s read ROCE vs ROI below –

| Return on investment | Return on capital employed |

| It is the financial ratio that determines the total profits earned over the total cost of investment. | It is a financial ratio that determines the total earnings before interest and tax over the total capital employed by the business. |

| It determines the efficiency of the money invested in a specific project. | It determines the efficiency of the capital employed by a business. |

| ROI formula= ( Profits from investment / Cost of investment ) *100 | ROCE ratio formula = ( Earnings before interest and tax / Capital employed ) *100 |

What is the difference between capital employed and invested capital?

Invested capital is that part of the total capital employed which is circulating in the business. However, capital employed is the total equity and debt employed in the business. So, invested capital is a part of the capital employed. Therefore, the scope of capital employed is much broader than the scope of invested capital.

Example of return on capital employed (ROCE)

Assume Company X has total assets of Rs. 20 lakh and total liabilities worth Rs. 10 lakh. The current liabilities of the company are worth Rs. 5 lakh. The earnings before interest and tax are Rs. 9 lakh. Then, below is how the ROCE calculation for Company X would be done.

Capital Employed = Total Assets – Total Current Liabilities

Capital Employed = Rs. 20 lakh – Rs. 5 lakh

Capital Employed = Rs. 15 lakh

Return on Capital Employed = EBIT / Capital Employed

Return on Capital Employed = Rs. 9 lakhs / Rs. 15 lakhs

Return on Capital Employed = 60%

This means that the company generates Rs. 60 for every Rs. 100 of capital invested in the business.

Let’s take a look at another example. Assume Company Z has EBIT of Rs. 2 cr., shareholdings of Rs. 2 cr. and total liabilities of Rs. 3 cr. Current liabilities stand at Rs. 1 cr. Then the return on capital employed for Company Z is as follows –

Capital employed = Shareholder’s equity + Long-term debt

Capital employed = Shareholder’s equity + (Total liabilities – Current liabilities)

Capital employed = Rs. 2 cr. + Rs. 3 cr. – Rs. 1 cr.

Capital employed = Rs. 4 cr.

Return on capital employed = Rs. 2 cr. / Rs. 4 cr.

Return on capital employed = 50%

This means that the company generates Rs. 50 for every Rs. 100 of capital invested in the business.

Conclusion

Making decisions for a business is a demanding process. Therefore, the stakeholders need to consider various efficiency as well as profitability metrics before taking decisions. Return on capital employed is one such significant profitability financial metric that must be taken into account. This is because it allows investors to know how efficiently their capital will be utilised in the business. Thus, the return on capital employed is a valuable measure and must be considered while taking decisions in different aspects of the business. Tickertape helps you analyse any asset thoroughly using various valuation ratios and metrics. Learn about how to use the latest Scorecard to analyse stock performance within a minute.

FAQs

Did you Like the Explanation?

Authored By:

I am a finance enthusiast who loves exploring the world of money through my lens. I’ve been dedicated to building systems that work and curating content that helps people learn.

As an insatiable reader and learner, I’ve spent the last two years exploring the world of finance. With my creative mind and curious spirit, I love making complex finance topics easy and fun for everyone to understand. Join me on my journey as we navigate the world of finance together!

Pranay is a BMS Graduate from KC College who has cleared all 3 levels of the CFA exam and is currently working as an Equity Research Associate at Alpha Invesco.