You will Learn About:

What is EPS?

Earnings Per Share (EPS) is an important metric that considers a company’s net profit and the number of outstanding common shares to determine the revenue the business generates per share of stock.

A company’s profitability can be determined based on its EPS. A higher EPS indicates higher profitability.

EPS – Key Points To Remember

- Earnings per share (EPS) is an important metric that measures the profit the company can generate for each share of its stock.

- If a company has a diverse capital structure that includes stock options, warrants, etc., diluted EPS is used instead of basic EPS.

- The EPS formula divides the company’s net income after tax by the total number of outstanding shares.

- A major limitation of EPS is that it can create a false perception of the company’s profits.

- EPS works best when compared against companies in the same industry or competitor metrics across a period.

How to calculate earnings per share?

Earnings per share are calculated in two ways. It requires dividing a company’s net income by the total number of outstanding shares. One way involves using the net income, whereas the other subtracts the dividend amount to get net profit. Additionally, there exists a method to obtain the Earnings Per Share (EPS) of any listed company with just a few clicks, eliminating the need for manual calculations. Continue reading to find out.

Earnings per share formula

The value of earnings per share is calculated by dividing a company’s net income by the available shares. Some organisations refine the calculation further by adjusting the numerator and denominator for outstanding shares that have been created through convertible debts, warrants, or options.

Below are the EPS formulae in both cases:

EPS = Net income of the company/Average outstanding shares

Weighted EPS = (Net income after tax – Total dividends)/ Total number of outstanding shares

The rationale behind subtracting dividends is to calculate net profit after the company has paid the dividends.

The total number of outstanding shares is often a weighted average over the period.

Earnings per share formula example

Assume a company announces a net income of Rs. 10 cr. It also announces dividends worth Rs. 75 lakh and has total outstanding shares of 1,20,00,000.

EPS = (Rs. 10 cr. – Rs. 75 lakh) / 1,20,00,000

EPS = 8.33

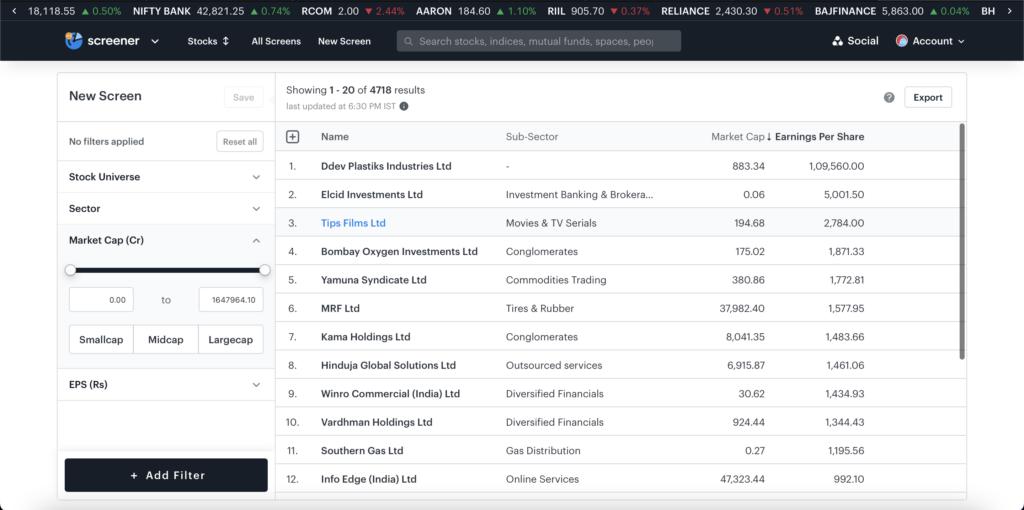

How to find EPS with a screener?

Using the Tickertape Screener, you can get the information on the EPS of any listed company within clicks. Here’s how.

- Log in to Tickertape

- Launch the Stock Screener

- Click on ‘Add Filters’

- Search and select ‘Earnings Per Share’

- You can sort the list of stocks by EPS parameter

Basic EPS vs diluted EPS

The formula mentioned above calculates the basic earnings per share. The problem, however, is that basic EPS doesn’t consider the dilutive effect of shares issued by the company.

Now, a company’s capital structure may include items like stock options, restricted stock units, warrants, etc. It also includes financial instruments that are used solely to raise capital. If these investments are exercised, they may increase the number of shares outstanding in the market. This will lead to a lower value of EPS.

Thus, companies also report diluted EPS to show the effect of additional securities on per-share earnings. This is based on the assumption that all outstanding shares have been issued.

Sometimes the numerator needs to be adjusted to calculate a fully diluted EPS. For instance, sometimes, a lender offers a loan that allows them to convert debt to shares upon fulfilment of some conditions. The shares created by convertible debt must be included in the denominator of the EPS formula to calculate diluted earnings per share. However, in that case, the company wouldn’t have paid interest on the debt. So, the interest already paid on convertible debt will be added back to the numerator of the earnings per share ratio formula to avoid distortion in the result.

Fast-growing companies often issue more shares as a part of their expansion strategy, and thus, share counts often increase. Using fully diluted earnings per share is thus a more conservative approach.

What is the difference between EPS and adjusted EPS?

When companies report their EPS values, they often use their net income numbers after adjusting them for one-time profits and expenses, such as losses due to specific events or earnings from sales of business units. The resultant value is adjusted EPS and is a more accurate indicator of financial health.

Some companies adjust their net incomes to boost their EPS values. By changing accounting procedures (for reported earnings) or aggressively buying back shares, companies can inflate their EPS value. Also, if components of non-recurring income are not adjusted for, the EPS value may appear high.

Importance of EPS

The EPS of a company is an indicator of its profitability. Here is why it is important:

- It helps to compare the performance of different companies and choose a suitable investment option.

- It helps to assess the financial progress of the company over the years. A steady increase in EPS may indicate that the company is profitable and, thus, a good investment option.

- A high EPS suggests high profitability and, thus, the likelihood of earning greater dividends.

- Besides current financial health, EPS also points to the company’s past performance.

Limitations of EPS

While EPS is commonly used and regarded as a powerful tool for financial analysis, it has its drawbacks. Here are some limitations for investors and business owners to keep in mind:

- Business owners often exaggerate EPS to create an illusion that their venture is yielding significant profits. However, this doesn’t have any benefits in the long run. On the contrary, this can negatively affect the reputation and profitability of the business in the future.

- EPS calculations do not take cash flow into account, and thus a high EPS may not be an accurate indicator of the company’s financial health. Also, for the same reason, EPS is ineffective in assessing a company’s ability to repay its debt.

What is a good EPS?

Whether it is a good EPS or not depends majorly on how it changes year after year and less on its absolute value. While it is important to see an annual increase in the absolute value of a company’s EPS, the rate of increase of EPS should also rise.

The EPS of a company can fluctuate based on the changes in earnings, the total number of outstanding shares, or both of these factors. The company can boost the EPS by either boosting earnings or using share buybacks to reduce the share count. However, EPS will drop if the outstanding share count increases faster than the earnings.

Stock investors can also assess a company’s EPS by looking at the P/E ratio and seeing how the share price changes relative to the earnings.

Conclusion

EPS helps to understand a company’s past and current financial performance. On Tickertape’s Stock Screener, you get EPS, quarterly EPS, and 1-yr and 5-yr historical EPS growth of companies. Investors use this value to make investment decisions. However, investors must look at the values comprehensively, as some companies may manipulate them for their gains. Consult your advisor before investing in a company.

FAQs

Did you Like the Explanation?

Authored By:

I'm a Senior Content Writer at Tickertape. With over 5 years of experience in the financial industry and insatiable curiosity, I bring complex financial topics to life in a way anyone can understand. My passion for educating others shines through in my approachable writing style.