Last Updated on Sep 28, 2021 by Aradhana Gotur

While the broader market indices – including the Nifty 50, information technology, banking, metals, infrastructure, realty, small caps and midcaps – continue to scale new highs, the auto sector shows no signs of a reversal yet. The sector has been reeling under the stress of multiple headwinds since as far as 2017.

Hit first by demonetization that dampened automobile sales in late 2016, followed by the supply chain disruption caused by the introduction of Goods and Services Tax in 2017, and then the liquidity crises brought about by the IL&FS fiasco in late 2018, the automobile sector has been battling one crisis after another. The high GST rate on automobiles at 28% has only made things worse.

The auto sector is a barometer of the broader economy. It accounts for 30% of the industrial GDP and 50% of the manufacturing GDP. It also employs 3.7 cr people. Click To TweetOn top of these adverse structural developments, the sector has also witnessed several regulatory blows, especially the introduction of new pollution emission norms. In April 2017, the mandate of shifting from the old Bharat Stage 3 (BS-III) to Bharat Stage 4 (BS-IV) emission norms left the manufacturers and dealers with high unsold BS-IV vehicle inventories. For those of you who may not know, these emission norms limit the maximum level of pollutants that a vehicle can emit into the air. The more recent norms are stricter.

Note that this shift to BS-IV emission norms was after only 4 mth of the demonetization exercise in December 2016. Around that time, the courts also mandated third-party insurance for the first 3 yrs to be paid upfront, thus raising the cost of vehicle ownership substantially and dampening sales.

More recently, we had the introduction of newer pollution emission norms in April 2020, which mandated the shift from BS-IV to the stricter BS-VI standards. This not only raised the cost of ownership – by 3-5% for compact cars and 8-10% for larger diesel vehicles – but also increased the inventory levels of BS-IV vehicles. And then, of course, the sector was hit by the pandemic, followed by the shortage of semiconductors in the global market.

While most of these were demand shocks to the sector, the semiconductor shortage was a supply shock which, as per many companies, is not expected to disappear for at least the next 3 mth. Here’s what Tata Motors’ management guided in their July 2021 concall:

Similar statements from Mahindra & Mahindra (M&M) in their August 2021 concall:

Another factor that has been ailing the auto sector in recent months is commodity price inflation – especially in steel, copper, and aluminium. This has prompted many companies to hike vehicle prices despite subdued sales. Maruti Suzuki, for instance, has reduced its advertisement and promotion expenses in recent months. This, of course, was in addition to raising car prices in an attempt to reduce the impact of commodity inflation. Below is a snippet from Maruti’s July 2021 concall transcript:

While these factors continue to exert pressure on the entire auto sector, a major factor that disproportionately impacts passenger vehicle sales is fuel prices. As per a 2019 RBI paper, the rise in crude prices impacts the valuation of passenger vehicle companies, mainly by reducing sales. In fact, the paper notes that on average, “a 100 basis points (bps) growth in fuel prices today will decrease automobile sales growth (excluding two-wheelers) by 72 bps two months down the line.”

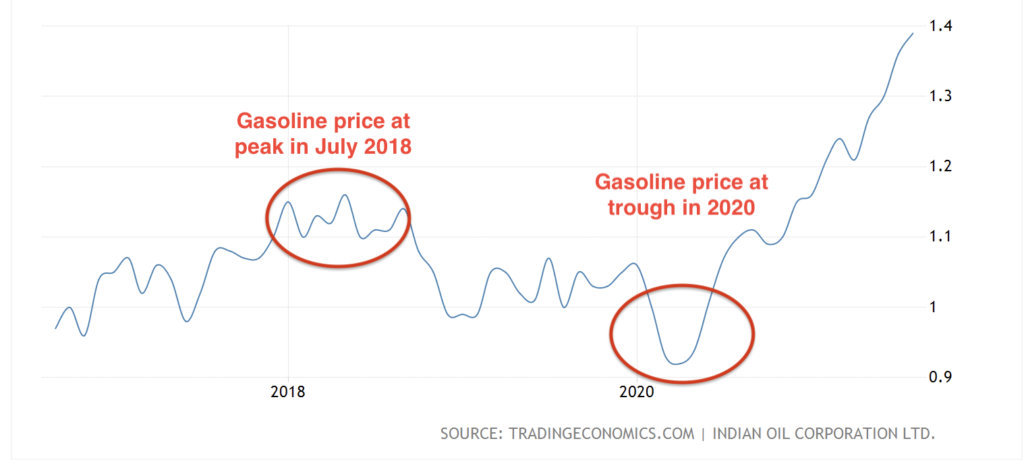

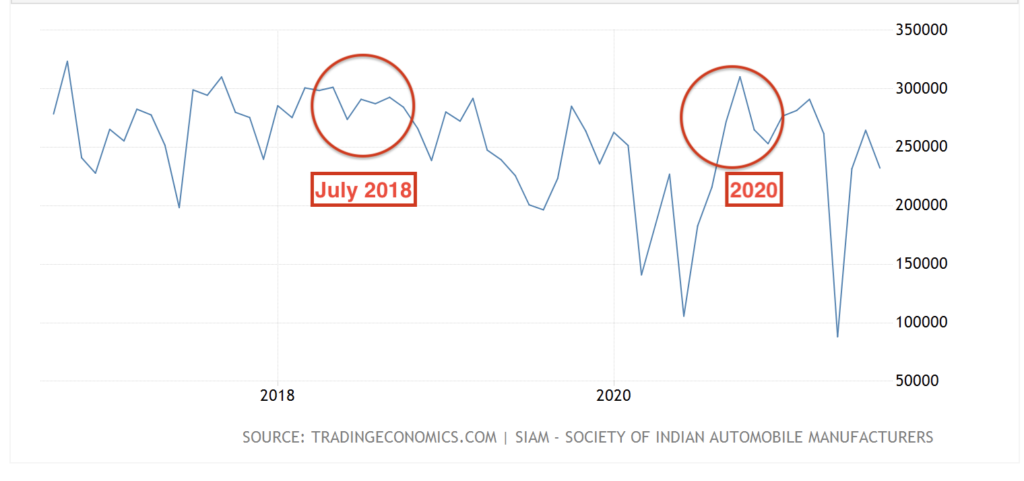

On average, a 100 bps growth in fuel prices today will decrease automobile sales growth (excluding 2-wheelers) by 72 bps 2 mth down the line. Click To TweetThis becomes clear when we notice the trajectory of fuel prices and passenger vehicle sales in 2018 as well as 2020. As observed in the chart below, India’s gasoline prices increased from March 2018 to Oct 2018:

During the same period with a lag of about 2 mth passenger vehicle sales remained muted:

In 2020, the crude prices crashed sharply, thus reviving auto sales as well.

Of course, there are other factors, including the need for social distancing, that may have contributed to the uptick in car sales in 2020, but the impact of fuel prices is well-documented in the RBI study.

In 2021, as fuel prices remain elevated, majorly owing to the elevated domestic excise and customs taxes, any meaningful uptick in auto sales may get delayed. The auto sector, remember, is a barometer of the broader economy. It accounts for as much as 30% of the industrial gross domestic product (GDP) and 50% of the manufacturing GDP. It also employs 3.7 cr people.

For the economy to grow meaningfully, the contribution of this sector is crucial. But also conversely, remember that the economy has been registering slow growth since 2017. Unless the broader economic growth picks up in the near future, it is tough for the auto sector to perform any better.

This sector, remember, is highly capital intensive. Most companies do not generate a return on capital employed (ROCE) above 7-8%. The market leader in the passenger vehicle segment has earned 0% earnings on a compounded basis over the last 10 yrs. M&M’s 10-yr compounded profit growth has been -5%.

Auto sector is highly capital intensive. Most companies do not generate a return on capital employed (ROCE) above 7-8%. Click To TweetThis is not to say that this sector may not make sense from a contrarian investing perspective, especially as a cyclical bet. But given that the sector’s fortunes depend heavily on a host of macroeconomic factors, it may help to study these closely — especially the domestic fuel price trajectory, regulation on insurance and pollution emission norms, broader economic growth prospects, interest rates on vehicle loans, global semi-conductor shortage, and more.