Last Updated on May 24, 2022 by Anjali Chourasiya

Portfolio diversification is the process of investing your money in different types of investments. Investing across various asset classes helps in risk diversification. Moreover, you can also get exposure to the profit potential of different asset classes and maximise investment returns.

Table of Contents

How to diversify your portfolio?

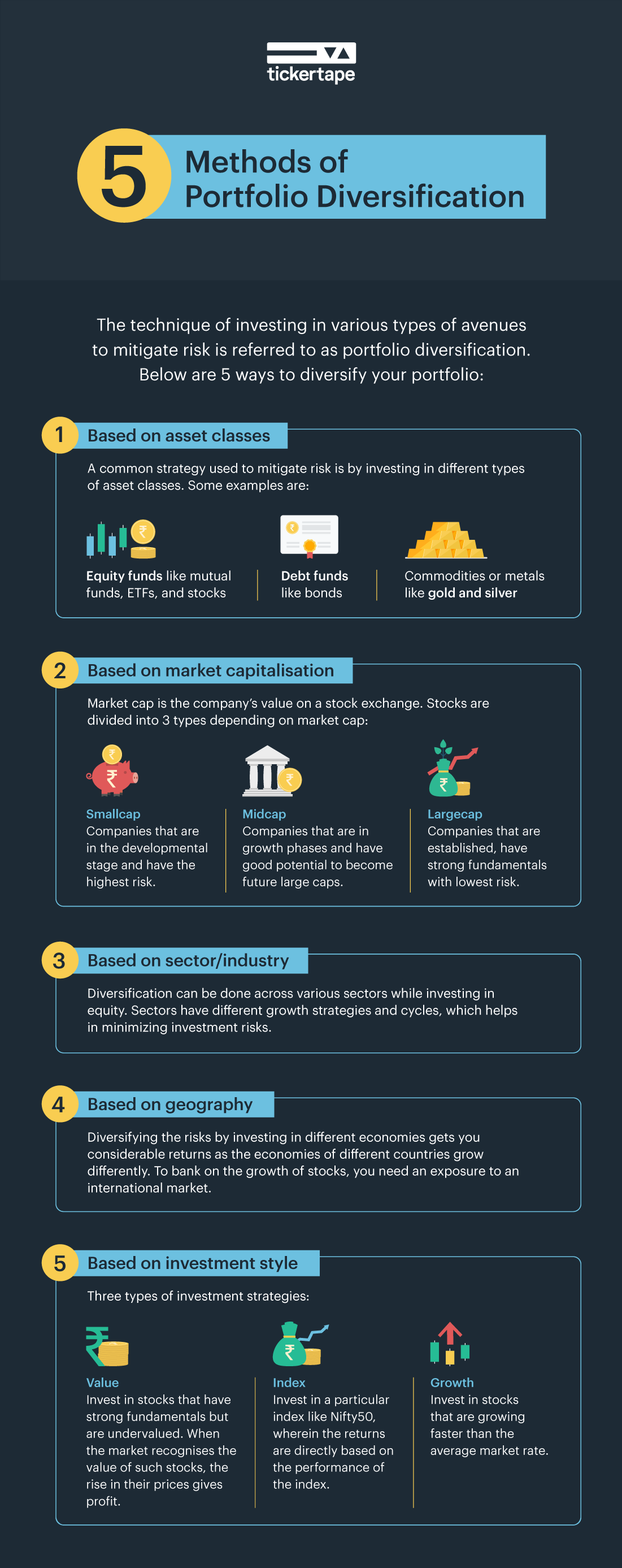

There are different ways in which you can diversify your portfolio. These ways are as follows:

1. Diversification based on asset classes

This, perhaps, is the most common type of risk diversification strategy. Under this method, you can choose to invest in different types of asset classes. An asset class is a group of investment avenues that have a similar risk-return profile.

Some of the asset classes available for portfolio diversification are:

- Equity funds like mutual funds, stocks, and ETFs

- Debt funds like bonds and government securities

- Fixed income avenues like fixed deposits, PPF, and NSC

- Real estate, such as buying a plot of land or investing in a property

- Commodities or metals such as gold and silver

2. Diversification based on capitalisation

This mode of diversification of risk is applicable if you are investing in equity funds. Market capitalisation is the company’s value on the stock exchange, i.e. the number of outstanding shares multiplied by their market value.

There are three types of companies in the stock market. They are largecap, midcap, and smallcap. Largecap companies are those that are established and have strong fundamentals. Therefore, they are sturdy enough to weather out market cycles. Midcap companies are in their growth phases and have a good potential of yielding returns. Lastly, smallcap companies are those that are in their developmental stage and rank below midcap companies on the stock exchange. While they can offer exceptional returns in an uptrend, they are also prone to considerable price fluctuations.

Largecap investments tend to have the lowest risk, while smallcap investments tend to have the highest risk. Therefore, you can choose to allocate your investment across stocks and securities based on market capitalisation to diversify risks and enhance the scope of returns.

3. Diversification based on sector/industry

While investing in equity, diversification can be done across different sectors. Since the growth cycle varies across different sectors, this method of risk diversification helps minimise investment risks.

For example, during the COVID-19 pandemic in 2020, even when the stock market crashed, stocks of pharmaceutical and FMCG companies offered good returns. So, by diversifying your portfolio across different sectors, you can earn returns from some companies even when there is a downtrend in the market.

4. Diversification based on geography

Why invest in a single country when you can expand your horizons? Stocks of established companies like Google, Apple, and Amazon are not listed in India. To bank on the growth of these companies, you need exposure to an international market.

The economies of different countries grow differently. Geography-based risk diversification means investing in different economies and diversifying the returns. For example, if you invest in the USA and its economy grows, you will get a considerable return.

5. Diversification based on investment style

You can also choose from different investment styles for diversification of risk. There are three types of investment strategies:

- Growth: In this strategy, you can invest in companies that are growing faster than the average market rate.

- Value: In this strategy, you identify companies with solid fundamentals but undervalued stocks. You can invest in such companies on the premise that when the market identifies the worth of such companies, their stock prices will grow, and you will earn returns in the process.

- Index: In this strategy, you track a particular index. For example, say, you consider Nifty 50 to be the benchmark index. Now, you can invest your money in the stocks listed on Nifty 50, and that too, in the same proportion. In this type of investment, the returns are directly based on the performance of the index.

While the growth strategy is easy, the value strategy requires considerable analysis to find undervalued stocks. On the other hand, index investing is comparatively easy as you do not have to pick the companies. You just have to choose the benchmark index.

Which diversification strategy is the right choice for you?

Understand the ways to diversify risks. Find out the risk diversification base that suits your investment strategy. All you need is a little knowledge about diversification. Also, beware of over-diversification as it may be counterproductive and your portfolio may become difficult to manage. Do your research and understand your preferences. Diversify according to your preference for risk minimisation and return maximisation.

With a fair understanding of the market, calculated moves, and experience, come handsome returns. #DimaagLagana hai toh investments mei lagao. And while doing so, keep your fears at bay kyunki #TickertapeHaiNa.