Last Updated on May 30, 2022 by

Joining the IPO rush of 2021 is the Rakesh Jhunjhunwala-backed Star Health and Allied Insurance Company Ltd. According to CRISIL Research, this company has continuously ranked number 1 in India’s retail health insurance market based on retail health gross written premium (GWP) for the previous three financial years. This is not all, so let’s probe deeper and read more about this company and its IPO.

Table of Contents

About Star Health

Star Health and Allied Insurance Company Ltd. was incorporated in 2006. According to CRISIL Research, Star Health is India’s largest private health insurer and the largest retail health insurance firm, with a gross written premium (GWP) of Rs. 93,489.50 mn. in FY2021.

In FY 2021, Star Health’s entire health insurance product suite covered 20.5 mn. individuals in retail health and group health, accounting for 89.3% and 10.7% of its total health GWP, respectively. Its products are aimed at a wide range of client segments, including individuals, families, students, senior citizens, and those with pre-existing medical issues in the larger middle market customer segment.

According to CRISIL Research, the Indian health insurance industry is still in its early stages and remains one of the world’s most underserved health insurance markets. The research goes on to show a number of demographic factors, including increasing life expectancy and population growth, are expected to drive growth in the Indian health insurance industry. Growing awareness of health insurance is another driver of this growth. This is due to the fact that the retail health insurance segment is particularly appealing due to its lower penetration, density, and claims ratio, as well as its higher premium per person, compared to other health insurance segments in India.

The company primarily sells insurance through individual agents, but it also includes corporate agent banks and other corporate agents. As of 31 September 2021, its network distribution in India had 779 health insurance outlets spread across 25 states and 5 union territories. Star Health has also successfully built one of India’s largest health insurance hospital networks, with ~11,778 hospitals.

Promoter and investors exiting their shares

The company’s promoters are Safecrop Investments India LLP, Westbridge AIF I, and Rakesh Jhunjhunwala.

About Star Health IPO

- This IPO is a 100% book building offer.

- The offer includes a fresh issue worth Rs. 2,000 cr. and an offer for sale (OFS) of up to 58,324,225 shares worth Rs. 5,249.18 cr. The issue size is Rs. 7,249.18 cr. at the top of the price range.

- The opening date for this IPO is 30 November 2021 and the closing date is 2 December 2021.

- Star Health IPO is likely to be listed on the BSE and NSE.

- The face value of each share is Rs. 10.

- The set price band of this IPO is Rs. 870 – Rs. 900.

- The allocation is expected to be finalised by 7 December, and refunds will be initiated by 8 December. Meanwhile, credit of shares in the Demat account is expected by 10 December.

- One lot consists of 16 shares and is worth Rs. 14,400 at the upper range of the pricing band.

- As of H1 FY 2022, Star Health’s existing paid-up equity capital is Rs. 553.29 cr.

Book running lead managers and registrar of the Star Health IPO

The joint global coordinators and lead managers of the Star Health IPO are Kotak Mahindra Capital Co. Ltd., Axis Capital Ltd., BofA Securities India Ltd., Citigroup Global Markets India Pvt. Ltd., ICICI Securities Ltd., CLSA India Pvt. Ltd., Credit Suisse Securities (India) Pvt. Ltd., Jefferies India Pvt. Ltd., Ambit Pvt. Ltd., DAM Capital Advisors Ltd., IIFL Securities Ltd. and SBI Capital Markets Ltd.

The issue’s registrar is KFin Technologies Pvt. Ltd.

Reservation of Star Health IPO for various investor categories

- 10% is the maximum subscription amount reserved for retail investors

- 15% is reserved for the Non-Institutional bidders (NII).

- 75% is reserved for the Qualified institutional buyers (QIBs), wherein 60% is for anchor investors, 1/3rd of which shall be reserved for domestic mutual funds only.

- Shares worth Rs. 100 cr. are reserved for the eligible employees of the company. They may get at a discount of Rs. 80 per share.

Objects of the Star Health IPO

- The proceeds of the offer for sale will be received by the selling shareholders.

- It intends to use the net proceeds of the offer towards augmentation of its capital base and to maintain solvency levels.

Financials of Star Health and Allied Insurance Company Ltd.

- As of 30 September 2021, it has posted a negative earnings per share (EPS) of Rs. 6.93.

- As of 30 September 2021, the net asset value (NAV) stood at Rs. 57.83.

- As of 30 September 2021, it has posted a negative return on net worth (RoNW) of 11.89%.

- As of 30 September 2021, it reported a negative EBITDA of Rs. 4,815.07 mn.

- Because the firm has reported losses for FY 2021 and H1-FY 2022, its P/E cannot be calculated.

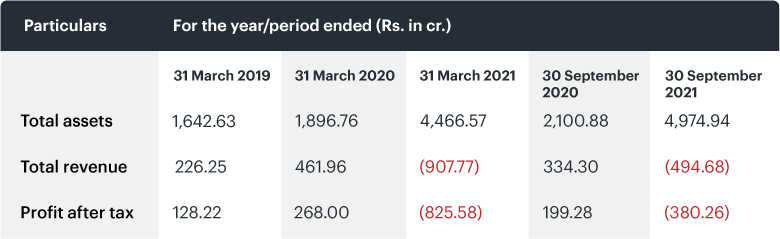

Following are the financials for 2019, 2020, and 2021

Peer comparison

According to the offer paperwork, the company’s listed peers include ICICI Lombard General Insurance Company Limited and New India Assurance Company Limited. They are not, however, completely comparable on an apples-to-apples basis.

Strengths of the company

- India’s largest private health insurance firm, with a strong presence in the lucrative retail health category.

- Pan India presence, and has one of the broadest and most widely spread distribution networks in the health insurance sector.

- Its integrated ecosystem allows it to continue to access the expanding retail health insurance market.

- Diverse product portfolio with an emphasis on innovative and specialised products.

- Strong risk management, with a superior claims ratio and excellent customer service.

- Experienced senior management team with strong sponsorship.

Risks of the Star Health and Allied Insurance Company Ltd.

Investments in equities and equity-related securities are risky. Before making an investment choice in an IPO, you should carefully consider the risk factors.

- The business reputation and market perception are vital to preserving market share and increasing its business. Any unfavourable publicity might have a major negative impact on its business, financial position, and operating performance.

- It has incurred losses in FY 2021 and the six months ended 30 September 2021 and may incur losses in the future, which could adversely affect its operations and financial conditions and the trading price of the shares.

- Its loss reserves are based on predictions of future claims liabilities, and if they prove to be insufficient, it may need additional reserve increases. This might substantially negatively affect its results of operations.

- Failure to adapt to technological development and the developing use of data in the Indian health insurance sector may jeopardise its capacity to sustain or enhance business volumes, profitability, and market share.

- Failure to meet the solvency ratio requirements, it may face regulatory action and could be forced to stop transacting any new business or change its business strategy, or halt its growth.

Star Health would become the fourth private sector insurance provider to list on Indian stock exchanges as a result of the proposed IPO. If you are interested in this investment opportunity, make sure to conduct thorough research before subscribing to Star Health IPO. To ensure a seamless experience while subscribing to Star Health IPO, read the article on how to subscribe to an IPO.