Last Updated on May 24, 2022 by Anjali Chourasiya

Sonam Srivastava is the Founder and CEO of Wright Research. Sonam has more than 9 yrs of professional experience in systematic portfolio management and quantitative trading.

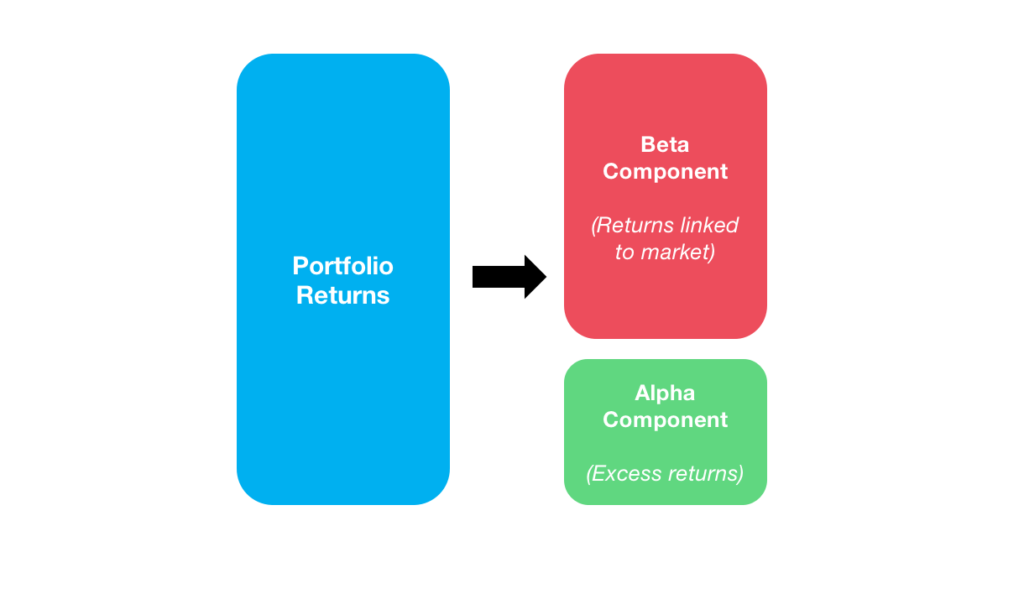

Alpha and beta are the favourite terms of a quant fund manager, and you’ll find us to use these terms to describe the performance of a stock or an investment portfolio very often. Here’s the story to introduce you to the terms. Around 70 yrs ago, the Modern Portfolio theory was presented that formalized that the return of any portfolio is proportional to its risk, and the return is a sum of the risk premium explained by the market and the stock-specific component.

The systematic component that can be explained by the stock’s volatility relative to a benchmark is the beta, and the excess return on investment is the alpha.

Table of Contents

What is the beta of a stock?

The beta is used to help investors understand whether a stock moves in the same direction as the rest of the market. It also provides insights into how volatile–or risky–a stock is relative to the rest of the market. A beta coefficient can measure the volatility of an individual stock compared to the systematic risk of the entire market.

A way to understand this is – a stock with a beta higher than one will move up more than the market when the market is moving up and move down more when the market is going down. An example of such a high beta stock is a banking stock like HDFC Bank. Conversely, a stock with a beta less than one will have a much-muted performance in either direction relative to the market, an example being an FMCG stock like ITC.

What is the alpha of a stock?

Alpha is often used in investing to describe an investment strategy’s ability to beat the market or its “edge.” There is a belief that markets are efficient, and so there is no way to systematically earn returns that exceed the broad market as a whole. Hence, any return above the market is the “abnormal” or “excess” return.

Active portfolio managers seek to generate alpha in diversified portfolios by picking stocks that can beat the benchmark.

How to evaluate a stock based on its alpha and beta values?

The alpha and beta values are ways to explain the characteristics of stock returns. Understanding these numbers will give you extra dimensions to your stock selection journey.

A stock with high alpha is always preferable, but alpha is fleeting and gets quickly arbitraged away. A good stock picker understands the rationale behind the alpha and can time the participation in high alpha stocks based on the opportunity.

The beta exposure is preferable based on the market. When the markets are trending, the high beta stocks will do better, but when markets tank, the high beta stocks will crash more, and low beta stocks will start to look more attractive.

Conclusion

The battle between alpha and beta defines the key characteristics of investor classes. A passive investor bets on beta and does not trust the elusive alpha but active investor bets on his ability to deliver the alpha. Who knows better? That is a never-ending debate.

Be as that may, the explanation based on beta and alpha is a better way to describe stock returns and enhances our understanding of the markets. Of course, as portfolio theory has evolved, the beta has paved the way for smart beta and better explanations, but understanding these two simple metrics can add an edge to our experience in the stock markets.

Hey before you go, we’ve got something special for you! On the occasion of Diwali 2021, we are gifting you a free Tickertape Pro upgrade. It’s #dimaaglaganekamuhurat! All you have to do is just sign up on Tickertape and avail the offer. Go on, claim your free account now!

- The Right Way To Analyse Growth Stocks in India - Jan 24, 2023

- How To Use Valuation Ratios To Evaluate Stocks? - Jul 4, 2022

- Significance of Alpha and Beta of a Stock - Nov 22, 2021