Last Updated on Aug 1, 2023 by Anjali Chourasiya

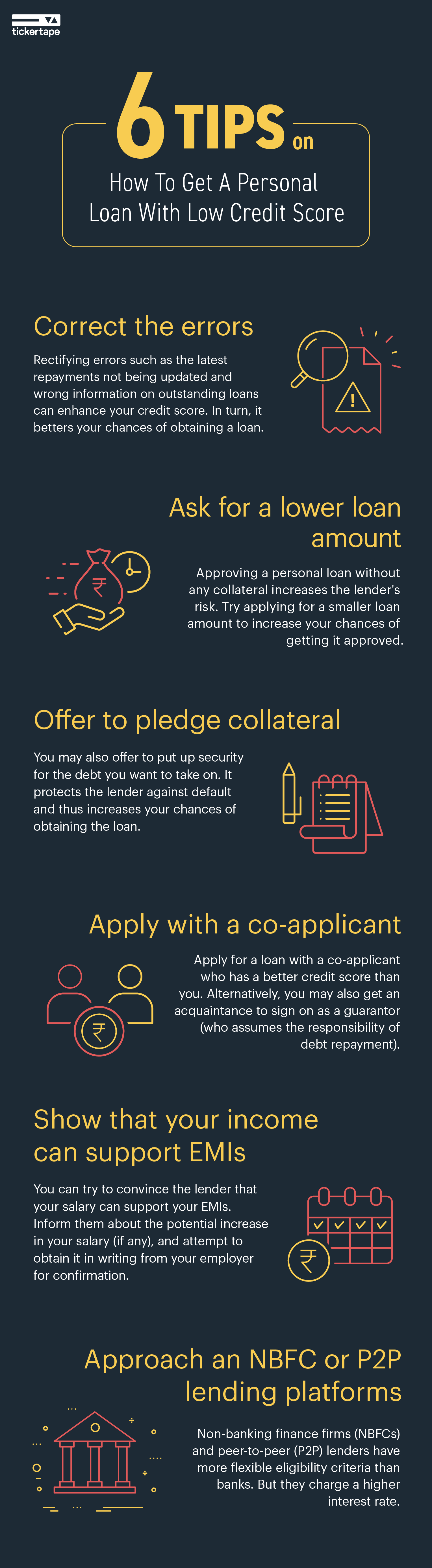

Availing a personal loan is probably the first thing that comes to your mind if you’re looking to address an emergency. And while a personal loan is often promoted as easy to secure, the process may not be smooth if you have a low credit score. Getting a personal loan with a low credit score can be difficult but not impossible. Here are 6 ways to secure a personal loan at reasonable interest rates despite having a low credit score.

Table of Contents

Correct any errors that may cause a bad credit score

Your credit score is the reflection of your credit history, like credit card bill payments, etc. It shows whether you kept up with the deadlines for the Equated Monthly Instalments (EMIs) on any loans you may have taken in the past. Accordingly, a credit score is assigned.

Credit scores generally range between 300 and 900. A score of 750 and above is considered good when you fulfil the credit obligations on time, which also makes it relatively easier to secure a personal loan.

Credit score generally ranges between 300 and 900. A score of 750 and above is considered good; anything lower makes it a hassle to prove creditworthiness to avail a personal loan.

However, there are occasions when the credit score may need to be corrected and not be a true picture of your financial health. The latest repayments need to be updated, and correct information on outstanding loans are two of the likely reasons resulting in a bad credit score. When rectified, such material errors can increase your credit score. So raise a dispute with the credit bureau to get them corrected.

Offer to pledge collateral

Alternatively, you could also offer to pledge security for the debt you wish to take on. It safeguards the lender from default and thereby improves your chances of securing the loan.

Ask for a lower loan amount

A personal loan is a collateral-free credit, and sanctioning it increases the lender’s risk. Ergo, in case you have a low credit score, consider applying for a lower loan amount to boost your chances of securing funds.

Apply with a co-applicant or get a guarantor

If a bank refuses to lend you because of a bad credit score, you could consider re-applying for the loan with a co-applicant who has a better credit score than you. Another option is to get an acquaintance to sign on as a guarantor.

A guarantor is someone who agrees to take on the responsibility of repaying the loan amount if you default on your debt repayment. The co-applicant with a good credit score or the guarantor acts as a reassurance to the lender that the personal loan will be repaid, bolstering your chances of securing the loan despite a bad credit score.

When applying for a personal loan with a low credit score, getting a co-applicant or a guarantor increases your chances of approval.

Show that your income can support EMIs

You can convince the lender that your income can support your EMIs. If you are expecting an increment soon, you can use this to your benefit. Let your lender know about the prospective rise in your income, and try to get that in writing from your workplace as well for proof.

Approach an NBFC or P2P lending platform

Borrowers who fail to secure a personal loan from a commercial bank could approach non-banking finance companies (NBFC) and peer-to-peer (P2P) lenders. NBFCs and P2P lenders are more flexible than banks when considering the eligibility of a prospective borrower. Thus, you still stand a good chance of securing a personal loan, but at a higher rate of interest.

If your loan is rejected on account of a low credit score, consider approaching an NBFC or a P2P platform. Their eligibility criteria of a potential borrower are more flexible and so your chances of getting a loan increase.

Conclusion

As discussed above, there are various ways to secure a personal loan despite a bad credit score. The trade-off of securing a personal loan with a low credit score is that you get a less attractive deal than other borrowers with a healthier credit report.

It is easy to maintain a good credit score by ensuring you pay EMIs on time and make sure to make all credit card bill payments. By preparing and sticking to a monthly budget, you can easily foresee and prepare in advance for any upcoming debt obligations.

FAQs

What credit score indicates bad credit?

A credit score of 624 and below qualifies as a bad credit score. In such a case, it may become difficult to avail a loan from a lender. The credit score ranges from 625 to 699 and is rated as fair, increasing the chances of getting the loan. However, it is always recommended by financial experts to maintain a credit score of 750 and above in order to smoothen the loan application process.

Which bank gives personal loans with bad credit in India?

Various banks and financial institutions in India offer personal loans with bad credit in India. Some of them are IDFC First Bank, ICICI Bank, HDFC Bank, Axis Bank, Yes Bank, Tata Capital, Fullerton India, IndiaBulls Dhani, Bajaj Finserv, and Muthoot Finance.

Who can apply for a bad credit loan?

You can apply for a personal loan with a bad credit score if you meet the following criteria.

- You are 18 yrs old and above.

- You are a citizen of India.

- You are a salaried or self-employed person.

- You have the ability to repay the loan amount on time.

The eligibility criteria differ from bank to bank and financial institution. Therefore, always recheck with your bank if you meet the criteria to avail the loan.

Is it possible to receive a personal loan with a credit score of 550?

A credit score of 550 is considered a bad score, and many reputable lenders would not provide you with a loan with such a score. However, there are many other options available such as applying for a loan with a co-borrower with a strong credit score. In case you are unable to find a secured loan, then you can apply for a secured loan. However, you will be required to provide collateral for these types of loans.

What are the dangers of bad credit loans?

If you apply for a personal loan with a bad credit score, you may end up repaying the amount with higher interest rates. It makes it difficult for you to get out of debt if you are already struggling.

- Best Fundamentally Strong Penny Stocks (2024) - Apr 10, 2024

- Best Liquor Stocks in 2024 - Apr 4, 2024

- All Pharma Penny Stocks in India: Pharma Shares Below Rs. 50 - Apr 2, 2024