Last Updated on May 24, 2022 by Anjali Chourasiya

It brought about days where all you have to do is open a mobile payment app on your phone, click ‘Pay’, and then select ‘QR code.’ Scan the receiver’s QR code and input the amount to be paid. And the funds will be transferred in a matter of seconds. One such online payment app is Paytm. When demonetisation happened, Paytm saw a 700% increase in overall traffic, a 1,000% increase in the value of money placed into Paytm accounts, and a record 5 mn. transactions per day.

Paytm is India’s largest financial services firm, providing customers, offline merchants, and internet platforms with full-stack payments and banking solutions. Through payments, trade, banking, investments, and financial services, the firm aims to integrate half a billion Indians into the mainstream economy. Paytm has now decided to go public. To assess whether to subscribe to Paytm IPO or not, trawl through this article for relevant details.

Table of Contents

About Paytm

One 97 Communications Ltd (Paytm) is India’s premier digital ecosystem for both consumers and merchants. This company was incorporated as “One 97 Communications Private Limited,” a private limited company on 22 December 2000. Following that, the company’s name was changed to “One 97 Communications Limited” in accordance with a new certificate of incorporation dated 12 May 2010 issued by the Deputy Registrar of Companies.

According to the Kantar BrandZ India 2020 Report, in 2009, the company launched the first digital mobile payment platform, “Paytm App,” to provide customers with cashless payment services. It has since grown to become India’s largest payment platform and the most valuable payments brand, with a total brand value of $ 6.3 bn.

Operations of the company

According to RedSeer, Paytm is India’s largest digital ecosystem for consumers and businesses. As of 31 March 2021, it provided payment services, commerce and cloud services, and financial services to 333 mn. consumers and over 21.1 mn. businesses. Its two-sided (consumer and merchant) ecosystem enables business and offers access to financial services through its financial institution partners by utilising technology to better consumers’ lives and assist merchants in growing their companies.

India is a country with hundreds of millions of young and aspiring customers that are underserved in terms of payment and financial services to meet their demands. Millions of small companies in India would benefit from improved access to inexpensive software, technology, and financial services. According to RedSeer, consumers and small companies may be served through technology-led, digital-first commerce. Due to considerable under-penetration and the capacity of technology to increase the industry, the market sectors that Paytm services have significant growth potential.

Services of Paytm

Because of the epidemic and subsequent lockdown, the total number of bank notes and money circulation has dropped, while internet payments have increased. Paytm allows customers to use its app to make cashless purchases in stores, top up mobile phones, send money online, pay bills, use digital banking services, buy tickets, buy insurance, opt for fixed deposit, buy gold, and invest, among other things. Merchants, on the other hand, can utilise the platform for advertising, online payment solutions, providing items to customers, and loyalty programmes.

Promoter and investors exiting their shares

This firm is professionally managed and does not have a known promoter in terms of SEBI ICDR Regulations and the Companies Act, 2013.

Among the selling shareholders:

- The founder Mr Vijay Shekhar Sharma is offloading shares worth Rs. 402.65 cr.

- Antfin (Netherlands) Holding B.V. is selling shares worth Rs. 4704.43 cr.

- Alibaba.com Singapore E-commerce Limited selling shares worth Rs. 784.82 cr.

- Elevation Capital V FII Holdings Limited offloading shares worth Rs. 75.02 cr.

- Elevation Capital V Limited is selling shares worth Rs. 64.01 cr.

- Saif III Mauritius Company Limited is offloading shares worth Rs. 1327.65 cr.

- Saif Partners India IV Limited is selling shares worth Rs. 563.63 cr.

- The SVF Panther (Cayman) Limited is offloading shares worth Rs. 1689.03 cr.

- And BH International Holdings is selling shares worth Rs. 301.77 cr.

About Paytm IPO

- This IPO is a 100% book building offer.

- The offer price is up to Rs. 18,300 cr., which includes a fresh issue of shares worth up to Rs. 8,300 cr. and an offer to sell shares of up to Rs. 10,000 cr.

- The face value of each share is set to be Re. 1 and the set price band is of Rs. 2,080 – 2,150.

- Paytm IPO opens for subscription on 8 November 2021 and the closing date is 10 November 2021.

- The lot size is 6 shares worth Rs. 12,900 at the upper range of the price band.

- The allocation is expected to be finalised by 15 November, and refunds will be initiated by 16 November. Meanwhile, credit of shares in the Demat account is expected by 17 November.

- The issue constitutes 13.13% of the post issue paid-up capital of the company.

- The company is looking at a market cap of Rs. 1,39,378.84 cr. post-issue (based on the upper price band of the IPO).

- Paytm IPO is likely to be listed on the BSE and NSE

Book running lead managers and registrar of the Paytm IPO

The joint global coordinators and lead managers of the Paytm IPO are Morgan Stanley India Company Private Limited, Goldman Sachs (India) Securities Private Limited, Axis Capital Limited (SEBI coordinator), ICICI Securities Limited, J.P. Morgan India Private Limited, Citigroup Global Markets India Private Limited, and HDFC Bank Limited.

The issue’s registrar is Link Intime India Private Limited.

Reservation of Paytm IPO for various investor categories

- 10% is the maximum subscription amount reserved for retail investors.

- 15% is reserved for the Non-Institutional bidders (NII).

- 75% is reserved for the Qualified institutional buyers (QIBs), wherein 60% is for anchor investors, 1/3rd of which is reserved for domestic mutual funds only.

Objects of the Paytm IPO

- Rs. 4,300 cr. will be used for growing and fortifying the Paytm ecosystem, particularly through acquiring users and merchants and giving them more access to technology and financial services.

- Rs. 2,000 cr. will be used to invest in new business ventures, acquisitions, and strategic alliances.

- General corporate purposes.

Financials of Paytm

- As of 30 June 2021, the net asset value (NAV) stands at Rs. 104.

- For the June quarter its revenue from operations rose 61% y-o-y to ~Rs. 890 cr.

- For the last three fiscal years, PB Fintech has posted a negative EPS of Rs. 42 and a negative RoNW of 36.90%.

- For the first three months ended on 30 June 2021, it posted a loss of Rs. 110.84 cr. on a total income of Rs. 258.17 cr.

- It has been posting negative earnings for all these years.

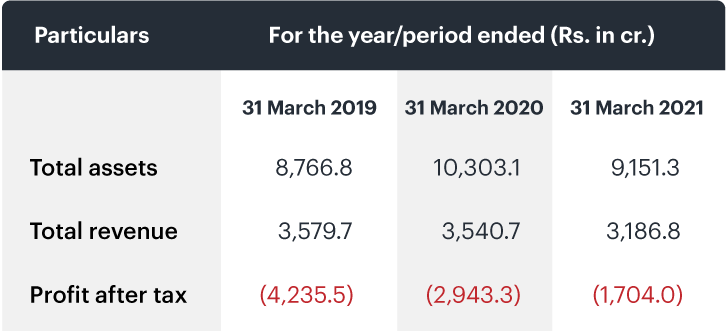

Following are the financials for 2019, 2020, and 2021

Peer comparison

As per the offer documents, PB Fintech has no listed peers in India that engage in a similar business.

Strengths of the company

- It is the leading digital payment service platform in India.

- With a brand worth of $6.3 bn., it has a strong brand identity.

- With 333 mn. overall consumers, 114 mn. yearly transactional users, and 21 mn. registered merchants, the company has a large client base.

- It has an app named Paytm Super for mobile phones to access a variety of digital payment services.

Risks of Paytm IPO

Investments in equities and equity-related securities are risky. Before making an investment in an IPO, investors should carefully consider the risk factors.

- Failure to maintain or develop the IT infrastructure may have a negative impact on the company and prospects.

- Some of the services are provided in collaboration with the group company, Paytm Payments Bank. Any failure by Paytm Payments Bank to support these services might have a negative impact on these services as well as the entire company, financial condition, and operating performance.

- It has a history of losses and expects to continue to incur net losses for the foreseeable future.

- Failure in attracting merchants to its ecosystem, growing relationships with existing merchants, and increasing transaction volumes on its platforms may adversely affect its operations, financial condition, cash flows and prospects.

- There are pending litigations against One97 Communications, its subsidiaries, and certain directors. Any adverse decision in such proceedings may adversely affect business, cash flows and reputation.

Prospects of the company

Paytm is a well-known brand for sure. If you are interested in this investment opportunity, make sure to conduct thorough research before subscribing to this IPO. To ensure a pleasant experience while subscribing to an IPO, read the article on how to subscribe to an IPO.