Last Updated on Jan 2, 2024 by Harshit Singh

Compounding, according to Warren Buffett, is the key to his investment success. Finding consistent compounding stocks that exhibit steady growth in revenue and profitability over time, with sound financials and competitive advantages, is an art that Warren Buffett perfected over the years. In this blog, we are going to replicate Warren Buffet’s investment success with the help of Tickertape Stock Screener and find out the best-compounding stocks in India.

Before we step ahead, let’s divulge ourselves into learning –

Table of Contents

What are compounding stocks?

Compounding stocks, also known as consistent compounders, exhibit steady growth in revenue and profitability over time with sound financials and competitive advantages. As a result, these stocks are a low-risk means of generating long-term wealth with the power of compounding.

Investing in compounding stocks is a long-term strategy that requires patience and a willingness to hold onto the stock for an extended period, allowing the power of compounding to work its magic.

(Note: Compounding in the stock market refers to the phenomenon of a company’s stock price growing exponentially over time as the market rewards it for its consistent performance.)

5 Most Traded Consistent Compounding Stocks In India

| Stock Name | Sub-Sector | Market Cap (Rs. in cr.) | Close Price (Rs.) | 1M Average Volume | Return on Equity (%) | Debt to Equity (%) | 1Y Historical Revenue Growth (%) | 1Y Historical EPS Growth (%) | 1Y Return vs Nifty (%) | PE Ratio (%) |

| Bharat Electronics Ltd | Electronic Equipments | 135,194.36 | 184.95 | 27,598,213.48 | 22.80 | 0.44 | 15.48 | 24.41 | 64.40 | 45.30 |

| ITC Ltd | FMCG – Tobacco | 583,920.86 | 468.05 | 12,572,792.71 | 29.00 | 0.44 | 16.82 | 25.30 | 20.53 | 30.43 |

| Engineers India Ltd | Construction & Engineering | 10,215.12 | 181.75 | 11,159,197.90 | 18.56 | 0.96 | 14.85 | 148.17 | 107.67 | 29.50 |

| Indian Railway Catering and Tourism Corporation Ltd | Online Services | 71,348.00 | 891.85 | 10,206,863.33 | 46.26 | 3.40 | 86.54 | 52.51 | 18.76 | 70.93 |

| Bls International Services Ltd | Outsourced services | 13,408.73 | 326.50 | 6,982,482.00 | 28.54 | 0.78 | 77.77 | 140.33 | 69.35 | 66.79 |

| Hindustan Aeronautics Ltd | Aerospace & Defense Equipments | 189,019.22 | 2,826.35 | 2,107,988.57 | 27.17 | 0.22 | 11.70 | 14.72 | 102.42 | 32.43 |

| Praj Industries Ltd | Construction & Engineering | 10,230.12 | 556.55 | 2,097,358.24 | 24.05 | 3.91 | 50.20 | 59.41 | 35.40 | 42.66 |

| Mazagon Dock Shipbuilders Ltd | Shipbuilding | 46,181.97 | 2,289.75 | 1,818,078.48 | 25.97 | 0.13 | 38.58 | 83.20 | 170.44 | 41.27 |

| United Spirits Ltd | Alcoholic Beverages | 80,532.29 | 1,107.20 | 1,088,358.81 | 20.90 | 3.06 | 13.47 | 37.07 | 7.22 | 70.87 |

| Jyothy Labs Ltd | FMCG – Household Products | 17,719.65 | 482.55 | 940,078.14 | 16.23 | 3.00 | 14.33 | 48.02 | 115.88 | 73.91 |

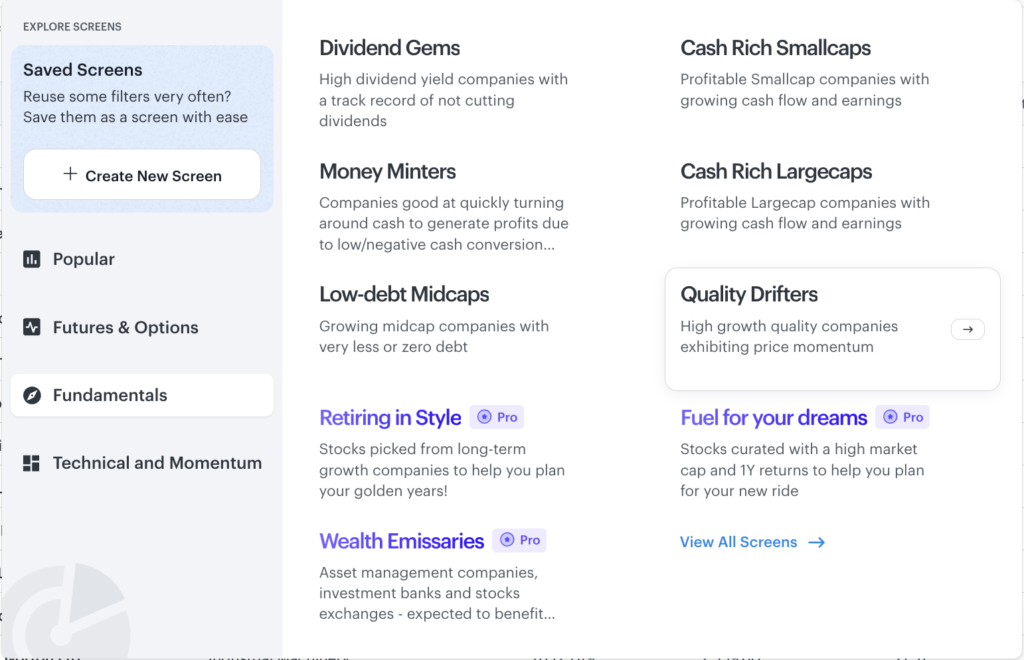

Note: The data is from 2nd January 2024 and filtered using Tickertape Stock Screener. The following parameters are derived from pre-defined basic screen ‘Quality Drifters’ which will provide high growth quality companies exhibiting price momentum.

The pre-defined basic screen consists of parameters such as –

- Stock Universe – Nifty 500

- Return on Equity

- Debt to Equity Ratio

- 1Y Historical Revenue Growth

- 1Y Historical EPS Growth

- 1Y Return vs Nifty

- 1M Trade Volume (Additional parameter applied to extract the most traded stocks in last one month)

Overview of best compounding stocks in India

Bharat Electronics Ltd

Bharat Electronics Ltd is a large-cap company that designs, manufactures and supplies electronics products/systems for defense as well as for nondefense markets. The stock has a 86% analyst rating and scores 7.6 for profitability on the ‘Scorecard,’ indicating good signs of profitability and efficiency. Its expected revenue growth for the next year is 13.53%, higher than the last 3 years’ CAGR revenue growth of 11.30%, which is a good sign for a company.

ITC Ltd

ITC Limited markets fast-moving consumer goods and operates in four segments: FMCG, Hotels, Paperboards, Paper and Packaging, and Agri-Business. Its profitability score on Scorecard (a pro feature that highlights the performance, growth, valuation, and growth of stock on the basis of different parameters) is 8.4, indicating good performance and growth potential. In addition, the company’s revenue has grown at a yearly rate of 9.83%, which is higher than the industry’s average.

Engineers India Ltd

Engineers India Ltd is a small-cap engineering consultancy, and engineering, procurement and construction company in the hydrocarbons and petrochemicals industry. Its debt-to-equity ratio for the last five years has been 0.32%, lower than the industry average of 190.25%. In addition, the company’s expected earnings growth for the next year is 20.12%, which is higher than the last 3-yr CAGR earnings growth of -2.79%.

Indian Railway Catering and Tourism Corporation Ltd

IRCTC is a mid-cap company engaged in catering and hospitality. The stock scores 8.5 for profitability on the ‘Scorecard,’ indicating good signs of profitability and efficiency. Also, the stock has no red flags, which is a promising sign.

Bls International Services Ltd

BLS International Services offers outsourcing services for visas, passports, and attestations to governments globally. It has a high-Performance Score of 7.8, indicating good profitability and efficiency with no red flags.

Why should you consider investing in consistent compounding stocks?

Here are four points on why you should consider investing in consistent compounding stocks:

- Long-term wealth creation: Consistent compounding stocks can be a great way to create long-term wealth. These stocks offer consistent growth in earnings and dividends, which are reinvested to increase the value of the investment over time. Over the long term, compounding can lead to significant wealth creation.

- Lower risk: Consistent compounding stocks are often low risk stocks than other types of investments. These stocks tend to be from established, well-managed companies with a track record of success. They also often pay dividends, providing investors with a regular income stream and helping to reduce the risk of the investment.

- Inflation-beating returns: Consistent compounding stocks have the potential to deliver returns that beat inflation. Over the long term, inflation can erode the value of money. However, compounding stocks that offer consistent growth in earnings and dividends can help to protect against inflation and maintain the purchasing power of your investment.

- Diversification: Consistent compounding stocks can be a great way to diversify your investment portfolio. By investing in stocks from different industries and sectors, you can reduce the risk of your portfolio and increase the potential for long-term growth. Diversification can also help to reduce the impact of market volatility on your investment returns.

In summary, investing in consistent compounding stocks can provide you with the potential for long-term wealth creation, lower risk, inflation-beating returns, and diversification for your investment

Patience is key, as compounding interest can create immense wealth. Consider Tickertape’s pre-built screen ‘Quality Drifters‘ to identify consistent compounding stocks easily.

FAQs

What are the benefits of investing in consistent compounding in the stock market?

Which is the consistent compounders screener in Tickertape?

Name 5 mid-cap consistent growth stocks in India.

These stocks are based on the following factors:

Apply ‘Quality Drifters’ pre-built screen.

Stocks are sorted (high to low) according to 1M trade volume.

- Digital Gold vs Gold ETF vs SGB – Where to invest in 2024? - Apr 15, 2024

- Highest Return Stocks in Last 1 Year (Nifty 500) - Apr 4, 2024

- Halal Stocks in India (2024) - Mar 26, 2024