Last Updated on Jul 25, 2023 by Harshit Singh

Stock market pundits say you only need a pen, paper, and a determined mind to make money on the bourses. And, when it comes to mind, Anil Kumar Goel surely wins! The 63-year-old is one of India’s top investors, with a net worth of Rs. 2,080.50 cr. But how does he get his hands on the future multi-bagger and make his riches? In this article, we will delve deeper into Anil Kumar Goel’s portfolio and analyse his investment style.

Table of Contents

Investor Profile – Anil Kumar Goel

Anil Kumar Goel is a seasoned Dalal Street investor enamored with small and micro-scale enterprise stocks.

| Investor name | Anil Kumar Goel |

| Place of birth | Amritsar, Punjab |

| Age | 63 |

| Spouse name | Seema Goel |

| Total net worth (Rs.) | Rs. 2,080.50 cr. |

| No. of portfolio companies | 35 |

| Major holding (%) | Dhampur Sugar Mills Ltd.and Dhampur Bio Organics Ltd. (12.70%) |

His first foray into the retail stock market occurred in the early 1990s. He entered the market in the 1990s and tested it for the first time in 1991-1992 when it fell. He deposited Rs. 50 lakhs in September 1992, but the market collapsed further in 1993, and his family wanted him to leave, but he insisted on staying. But when the market picked up, that’s when his portfolio and passion spiked in the stock market.

Anil Kumar Goel portfolio (2023)

Anil Kumar Goel has a net worth of 2,080.50 cr. and invests heavily in sugar, industrial, and textile industries. So, let’s have a deeper understanding of his portfolio and picks!

| Stock name | Holding value (Rs.) | No. of shares held | June 2023 holding (%) |

| DCM Ltd | 1.4 cr. | 1,90,000 | 1.00% |

| LG Balakrishnan & Bros Ltd | 46.8 cr. | 3,98,000 | 1.30% |

| Indsil Hydro Power and Manganese Ltd | 3.0 cr. | 6,90,001 | 2.50% |

| Uttam Sugar Mills Ltd | 95.2 cr. | 28,19,000 | 7.40% |

| Magadh Sugar & Energy Ltd | 21.9 cr. | 5,22,000 | 3.70% |

| TCPL Packaging Ltd | 153.5 cr. | 9,46,000 | 10.40% |

| KRBL Ltd | 378.5 cr. | 1,03,21,000 | 4.40% |

| Amarjothi Spinning Mills Ltd | 8.5 cr. | 4,57,000 | 6.80% |

| Dhampur Sugar Mills Ltd | 231.8 cr. | 84,31,000 | 12.70% |

| Dwarikesh Sugar Industries Ltd | 115.8 cr. | 1,27,00,000 | 6.70% |

| Nahar Capital and Financial Services Ltd | 12.2 cr. | 4,08,000 | 2.40% |

| Nahar Spinning Mills Ltd | 62.6 cr. | 24,19,000 | 6.70% |

| Omaxe Ltd | 10.4 lakh | 21,000 | 0.00% |

| Panama Petrochem Ltd | 22.3 cr. | 7,60,000 | 1.50% |

| Precot Ltd | 10.2 cr. | 6,32,000 | 5.30% |

| Sanghvi Movers Ltd | 25.8 cr. | 4,54,000 | 1.10% |

| Sarla Performance Fibers Ltd | 13.7 cr. | 27,80,000 | 3.30% |

| Star Paper Mills Ltd | 4.3 cr. | 2,48,000 | 1.60% |

| Triveni Engineering and Industries Ltd | 226.1 cr. | 76,50,000 | 3.50% |

| Vardhman Holdings Ltd | 61.5 cr. | 2,20,000 | 6.90% |

| Dhunseri Tea & Industries Ltd | 6.9 cr. | 3,21,000 | 3.10% |

| K G Denim Ltd | 1.4 cr. | 4,90,000 | 1.90% |

| South India Paper Mills Ltd | 17.9 cr. | 17,02,000 | 9.10% |

| Sri Lakshmi Saraswathi Textiles (Arni) Ltd | 62.6 lakh | 1,84,100 | 5.50% |

| Samtex Fashions Ltd | 87.6 lakh | 42,50,000 | 5.70% |

| Ador Fontech Ltd | 5.5 cr. | 4,50,000 | 1.30% |

| Avadh Sugar & Energy Ltd | 76.7 cr. | 13,81,000 | 6.90% |

| DCM Nouvelle Ltd | 7.0 cr. | 4,32,000 | 2.30% |

| Dhampur Bio Organics Ltd | 142.6 cr. | 84,58,000 | 12.70% |

| Vardhman Special Steels Ltd | 34.7 cr. | 18,08,154 | 2.20% |

| GRP Ltd | 5.0 cr. | 13,800 | 1.00% |

| Austin Engineering Company Ltd | 1.3 cr. | 67,878 | 2.00% |

| Dalmia Bharat Sugar and Industries Ltd | 185.7 cr. | 49,39,000 | Filing Awaited |

| Majestic Auto Ltd | 3.1 cr. | 2,00,000 | Filing Awaited |

| G K Consultants Ltd | 2.7 lakh | 30,000 | Filing Awaited |

Anil Kumar Goel portfolio analysis

Anil Kumar Goel is well-known for his steady approach to investing. He is fond of sugar and industrial stocks, which is reflected in his portfolio. For this quarter, he ventured deeper into these industries and added 3 more companies to his portfolio while buying more shares of Uttam Sugar Mills Ltd. and Magadh Sugar & Energy Ltd.

| Stock name | Holding value(Rs.) | No. of shares held | March 2023 change (%) | June 2023 holding (%) | June 2023 change (%) |

| DCM Ltd | 1.4 cr. | 1,90,000 | – | 1.00% | New |

| LG Balakrishnan and Bros Ltd | 46.8 cr. | 3,98,000 | – | 1.30% | New |

| Indsil Hydro Power and Manganese Ltd | 3.0 cr. | 6,90,001 | – | 2.50% | New |

| Uttam Sugar Mills Ltd | 95.2 cr. | 28,19,000 | 7.20% | 7.40% | 0.20% |

| Magadh Sugar & Energy Ltd | 21.9 cr. | 5,22,000 | 3.60% | 3.70% | 0.10% |

In this quarter, some stocks didn’t align with his investing approach, and he decided to sell some % of shares to minimise the risk.

| Stock name | Holding value(Rs.) | No. of shares held | March 2023 change (%) | June 2023 holding (%) | June 2023 change (%) |

| GRP Ltd | 5.0 cr. | 13,800 | 1.10% | 1.00% | -0.10% |

| Austin Engineering Company Ltd | 1.3 cr. | 67,878 | 2.20% | 2.00% | -0.20% |

Anil Kumar Goel’s net worth in 2023

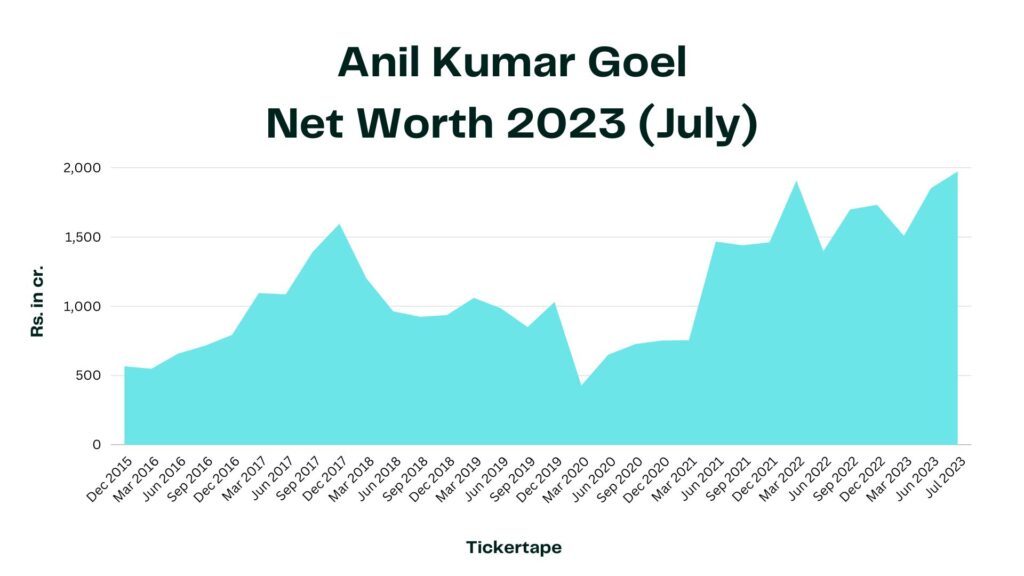

Anil Kumar Goel’s net worth has moved sharply during the last few years, especially post-Covid lockdown. The portfolio that first valued at Rs. 567.21 cr. in December 2015 is Rs. 1,973.56 in June 2023. His net worth trend over the last eight years looks like this:

Anil Kumar Goel bulk and block deals in 2023

Bulk and block deals enable transparency and explain why stock volumes have increased or dropped. The disclosure of bulk and block transactions can aid in determining which industries are gaining and losing popularity with purchasers. It also influences future investment decisions made by individual investors. Using Tickertape’s Stock Deals tool, you can identify and analyse bulk and block deals for a particular period of an investor. While checking on the bulk and block deals of Anil Kumar Goel for the last quarter, there is none.

Conclusion

Anil Kumar Goel is known as the “Sugar Baron” on Dalal Street due to his efficacy for sugar stocks. His strong eye for small and micro-scale firms sets him apart as one of India’s most influential investors. You can also keep an eye on the market by using Tickertape’s Stock Screener to stay up-to-date on market trends and choose top stocks to add to your investment portfolio!

- Digital Gold vs Gold ETF vs SGB – Where to invest in 2024? - Apr 15, 2024

- Highest Return Stocks in Last 1 Year (Nifty 500) - Apr 4, 2024

- Halal Stocks in India (2024) - Mar 26, 2024