Last Updated on Dec 1, 2022 by

Now that we have shortlisted a few companies out of 5000+ listed companies in India, you must be wondering which ones to prioritize or which company or industry you should study first. Sometimes, a few companies shoot up even before you start studying them. Has this ever happened to you? If yes, then keep on reading this article to avoid the same in the future.

The end goal of everyone investing in the stock market is to create wealth. There are two sources of earnings in the stock market – price return and dividend. We will focus on price return (dividend is insignificant in most cases as well as an uncontrollable factor). Let’s first understand the components of the market price of any company so that we know the key factors driving the price of any company.

Price = Earnings Per Share (EPS) * Earnings Multiple

Suppose the EPS of a company is Rs. 10 and the market is willing to pay Rs. 12 for every Re. 1 earned by the company (earnings multiple). So the price of the company will be 10*12 = Rs. 120. Now, prices can move up because of two reasons – either the earnings of the company increase or the multiple that the market is willing to pay increases. As long as earnings continue to meet or exceed the market expectations, earning multiple stays there or re-rates. However, if the company disappoints in earnings growth, the market waits for a maximum of two quarters before earning multiple de-rating journeys begin.

Table of Contents

Journey of a stock

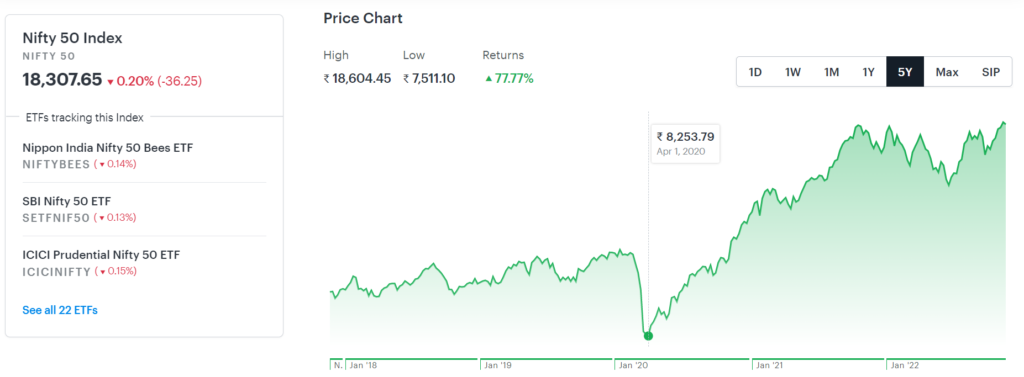

There are three important observations we can draw from the above chart –

- The majority of returns in the long term can be attributed to earnings growth and not earnings multiple

- Earnings multiples are based on the expectations of earnings growth.

- The market is forward-looking, and most of the ‘known’ and ‘known unknown’ factors are priced in. Only the ‘unknown unknown’ brings a significant correction in the price.

It’s difficult to bet on the earnings multiple as compared to earnings growth. So, for the time being, let’s just focus on earnings growth.

Earnings growth

There are two kinds of earnings triggers: One that is immediately going to affect the earnings significantly, i.e. inflection point in earnings, and another which is going to affect the earnings over time and not immediately in a significant manner.

For example, we all know that the penetration of Life Insurance or Mutual Funds, etc. is low in India and is bound to increase as per capita income increases which will ultimately reflect in the company’s earnings. But just because the penetration is low, not everyone will start buying insurance today. So, though earnings will grow yearly, there won’t be a significant jump in any particular year. Since the runway for growth is huge, these might be interesting ideas to look at from a long-term perspective but wait for technical analysis to give entry signals.

However, suppose there is any news, be it a government regulation or political situation, etc., which specifies an immediate ban on the use/import/export of certain products, then there is a very high chance that the earnings of the substitute product/manufacturer will see a significant jump immediately if they have enough capacities to cater the demand or if they can create additional capacities in a short time. So, if your time horizon is short or long-term, this is a perfect example for you as your returns will be a factor of both earnings growth and multiple re-rating in the short term and very high earnings growth in the long term.

For example, lower labor costs, high subsidies, and relaxed environmental norms led to the emergence of China as the most dominant player in the chemical industry. But in 2017-2018, the Chinese Government asked chemical companies to shut their plants due to environmental concerns, forcing global chemical companies to diversify their supply chain. India emerged as a beneficiary due to labor cost advantage along with strict adherence to Intellectual property (IP) and the ability to expand capacities rapidly. And this led to a significant jump in revenues and profitability -> earnings multiple re-rating -> Increase in the share price of the Indian chemical companies.

Another example of this is the defence sector. India was majorly dependent on Russia for its defence requirements. After the news of the Russia-Ukraine war, India started its journey to becoming self-reliant and Indian companies saw huge orders coming their way which was also reflected in the price.

So, look for companies that can grow their earnings at a fast pace and can sustain it for long periods.

As you can see from the above chart, in the long term, earnings growth has been a key driver of returns. As the growth declines or matures, multiple de-rating happens, and hence the majority of price return can be attributed to earnings growth.

However, in the short term, an improvement in earnings growth trajectory expectation leads to multiple re-rating (as the market is forward-looking and future expectations are already priced in). So, most returns can be attributed to earnings multiple re-rating and not to earnings growth in the short term.

Now you must be wondering how to catch this short-term move on time.

You must have noticed that even though China +1 became popular in 2017-2018, most of these companies bull runs started in 2014-2015. Another example is the Indian market bottomed out in the week when the lockdown was announced, which clearly shows that markets are forward-looking and move based on expectations.

So, in order to catch the trend early, one can take a look at Price-Volume action across industries and companies.

If all the stocks of a particular industry break out, one can start looking at that industry and can try to find out the fundamental reason for the same. Another qualitative way to find that the sector is breaking out is to look at the management commentary of various companies in that sector. When the most conservative management also looks excited about future growth prospects, it’s time to load up in that sector.

So, technical will give you the first sign of entry based on which you can start your research, and you can keep adding at every breakout post the initial entry if your thesis is playing out.

Let’s take the example of Navin Fluorine to understand the same.

Source: Company AR & Concall

Let’s take the example of Navin Fluorine to understand the same.

In June 2014, Navin Fluorine gave a multiyear price breakout (1st sign of entry).

FY 2015 was a good year in terms of revenue growth, but margins took a hit. From FY 2016, margins also started increasing as the share of high-value products increased. Hence we saw PE re-rating in ~June-July 2015, and at the same time, from June 2014 to December 2017, price increased 8-9x even though FY 2017-2018 was the time when the China+1 theme started gaining momentum, and we already had a huge up move by this time (the market is always forward-looking).

FY 2018 was again a good year. This was when the China + 1 theme was the talk of the town. For ~2 yrs, i.e. from December 2017 to October 2019, the stock was trading sideways.

There was a fresh breakout in October 2019 (a sign to increase the position in the stock, again, if you noticed an early sign given by technicals to enter before the huge order).

February 2020 was the inflection point for the company as it entered into an Rs. 2,900 cr. multi-year contract. Also, this was when the China +1 theme gained all the more momentum due to COVID. The company started doing a lot of CAPEX from here on. And a major PE re-rating (30x to 70x) happened based on the company’s earnings growth outlook.

From here on, it becomes very important to track whether the company can execute well and meet or exceed growth expectations. Otherwise, there will be a huge PE de-rating in the coming quarters.

Conclusion

- Use the technical analysis for entry decisions and for adding to your existing position.

- If your investment horizon is 3-5 yrs, focus on companies and industries which are at an inflection point of earnings growth and hence will result in earnings multiple re-rating. So your price return will be exponential as it is a combination of both earnings growth as well as earnings multiple re-rating.

- Invest in a company where earnings growth can sustain for long periods of time, where chances of disruption are low, and the management quality is top-notch if you are a very long-term investor.

- Research Framework 1O1 – Part 1 - Apr 19, 2023

- How To Prioritise Company or Industry Research Post Shortlisting? - Dec 1, 2022

- How To Shortlist Good Companies Out of 5000+ Listed Companies? - Oct 28, 2022