Last Updated on May 24, 2022 by Aradhana Gotur

There comes a phase in life when you start earning well, and instead of spending all of it, you think of investing a decent portion of your earnings in stocks, mutual funds, gold, and index funds.

The question is, where to invest? Is it in mutual funds or stocks, gold or index funds? There are plenty of choices. But if you are looking for investing in index funds, here is a guide on why these can be a viable option. After all, it’s your hard-earned money, and you have to find the right investment vehicle.

Table of Contents

What is an Index Fund?

Simply put, an index or index mutual fund is a tool that measures changes of indices of stock markets like Sensex of BSE and Nifty of NSE.

Let’s say you have invested in the NSE Nifty index, also called Nifty50. This index mutual fund tracks Nifty50 and distributes your money among the top 50 companies listed in the index.

Each listed company holds a weight ratio. For instance, in 2021, HDFC Bank Ltd has a weight ratio of 10.38% and Reliance Industries Ltd has a weight ratio of 10.33%, while Infosys Ltd has a weight ratio of 8.09%. This keeps changing over time.

Let’s say you invested Rs. 1,000 in Nifty; then the index fund will invest:

- 10.38%, that is Rs 103.8 in HDFC Bank Ltd

- 10.33%, that is Rs 103.3 in Reliance Industries Ltd

- 8.09 %, that is Rs 80.9 in Infosys Ltd

This process holds good for the remaining 47 companies as well.

4 Factors to look out for before investing

Investing in index funds is a much better option if you are looking for a long-term investment. Even Warren Buffet once said that it is heaven for risk-averse investors and for those who want to invest a part of their income at a young age because it will give a handsome return in the long run. Now, without any delay, let’s discuss the factors you should look out for before investing in index mutual funds.

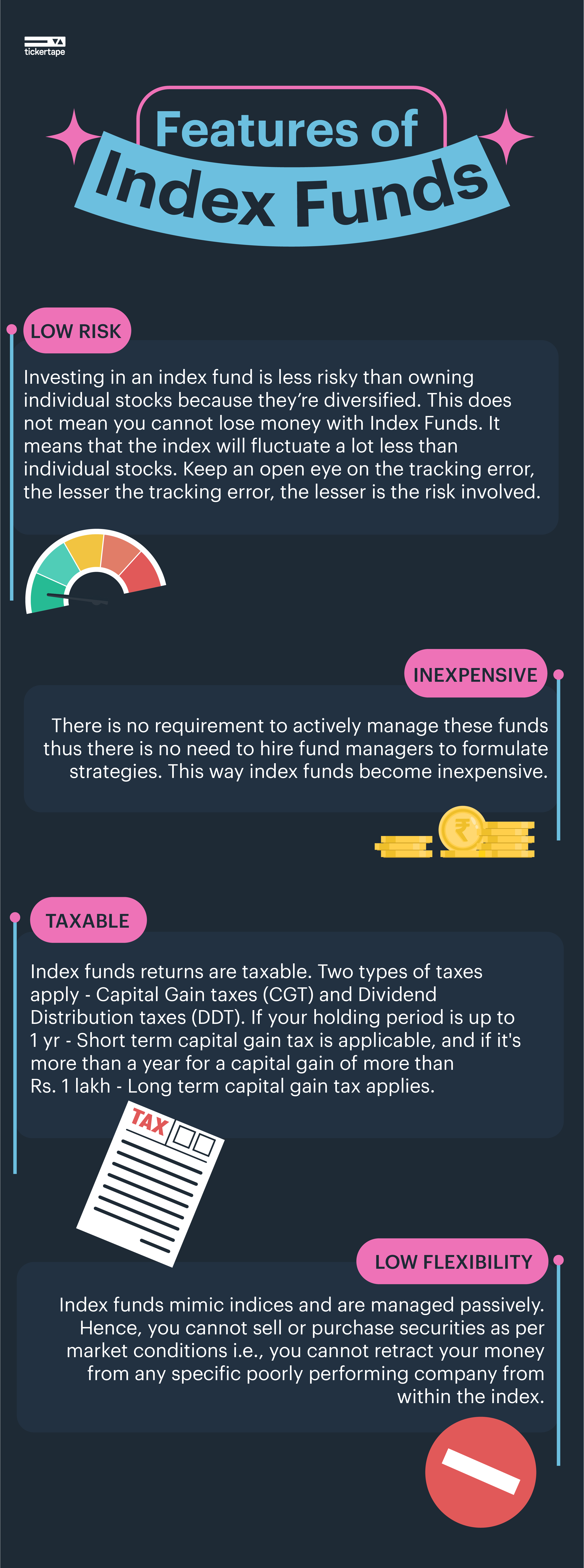

1. Risk involved

The risk involved in index mutual funds is slightly less because of their passive nature, and these are less volatile compared to actively managed funds. But one thing that you should keep an eye on is its tracking error. The lesser the tracking error, the lesser are the chances of risks involved and vice versa. You must invest some portion in active funds like equities because if the market performs poorly, then it will affect index funds as well.

2. Are they expensive?

This might be the highlight for some investors as index funds don’t need to be managed actively. So, no fund manager is required to handle these funds or formulate any strategy. Hence, these funds are inexpensive, and there are funds that have higher returns at a low expense.

3. Are index fund returns taxable?

There are 2 types of taxes that are applied on index mutual funds: Capital Gain Taxes (CGT) and Dividend Distribution Taxes (DDT). Let’s take a look at both of these.

a. Capital gain taxes

If the holding period of index funds is up to one year, then Short Term Capital Gain Tax (STCG) applicable is 15%. And if the holding period of index funds is more than one year, then Long Term Capital Gain Tax (LTCG) is applicable, but there are 2 scenarios:

- If LTCG is up to Rs. 1,00,000, then no tax is applicable

- If LTCG is more than Rs. 1,00,000, then a flat 10% is taxable

b. DDT (Dividend distribution tax)

If you fall under the category of individuals whose annual taxable income is more than Rs. 5,00,000, then 30% will be deducted from the index funds dividend.

4. Low flexibility

As mentioned before, index funds imitate the indices and manage passively; hence fund managers can’t sell or purchase securities at their own will as per the market conditions. For example, if one of the listed companies performs poorly and the other is performing well, then it’s not possible to retract the fund from a poorly performing company.

Considering the Indian mindset, we can say it is beneficial to invest in index funds for the long term only because it imitates the equity market and gives minimal benefit in the short term.